Late last month it was announced that MTD for income tax self-assessment (MTD ITSA) would be postponed (again) to April 2024.

The most concerning part is that more people are likely to be aware for the delay than know about MTD itself. Hence why we have decided to highlight this in today’s blog.

What is MTD?

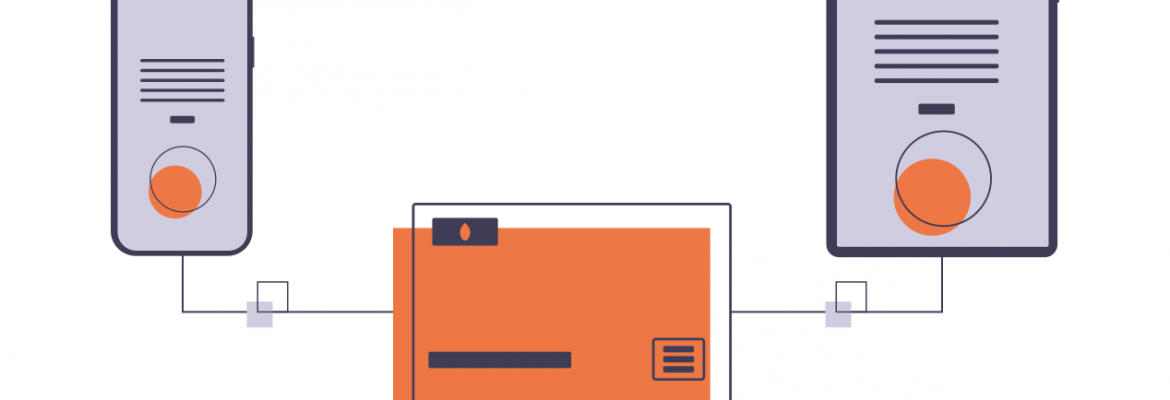

Making Tax Digital (MTD) is a UK government initiative that sets out a vision for the ‘end of the tax return’ and a ‘transformed tax system’. The goal for this was initially by 2020.

HM Revenue and Customs states that the main goal of MTD is to make tax administration more effective, more efficient and simpler for taxpayers.

With recent events HMRC have expressed how important up to date information is within a business, whether that be to claim for funding available or to plan for the future. MTD requires data on a quarterly basis from records stored electronically.

Business taxes were being digitalised in stages starting with VAT, moving onto income tax and then corporation tax.

Long time coming

Initially proposed in 2015 by George Osborne, there has been a series of delays and deferrals in the launch of MTD.

The focus for MTD started with VAT. The MTD for income tax programme was to be delayed until lessons had been learnt from this roll-out.

MTD for VAT commenced for most VAT registered businesses for VAT periods starting on and after 1 April 2019 but a number of “complex” entities had a deferred start date to 1 October 2019.

History appears to be repeating itself with MTD for Income Tax Self Assessment (ITSA) whereby general partnerships (ie not LLPs, mixed or corporate partnerships) are due to enter MTD ITSA from April 2025, this is a year after sole traders and landlords who have recently been pushed back to 2024.

Due to the delays that have already occurred it is still unknown if MTD for corporation tax project will start as planned in 2026 or not.

What is next?

The final stages of MTD for VAT are effective from April next year.

All VAT registered businesses must comply by keeping digital records and making submissions through a software. Please note: registration for Making Tax Digital is required before this time.

For Income Tax Self Assessment, the same applied with regards to keeping digital records and submitting returns by electronic means. Also, similar to VAT, the new ITSA programme requires information quarterly.

As the turnover threshold must take into account the taxpayer’s income from all of their sole-trader businesses, plus their rental income, HMRC needs to pull together several figures from the taxpayer’s self assessment tax returns. Only when the tax return totals reach the £10,000 threshold will HMRC issue a notice to file under the MTD regulations.

To allow Self Assessment information to be sent in on the correct dates there needs to be a change of the basis period.

As MTD ITSA will now start in April 2024 the base year for testing the MTD turnover threshold will be the tax year 2022/23. The turnover figures for that year should not be distorted by Covid-related grants, and hopefully will reflect normal trading beyond the pandemic for most businesses.

Tax year basis

The basis year for assessment is assumed to be a big factor into why the new requirements have been pushed back a year.

It was apparent that HMRC wanted all unincorporated businesses to switch to the tax year basis before the introduction of MTD ITSA in 2023, but this would make 2022/23 the difficult transitional year.

Regardless of when the new rules start there is a lot of planning to be done by businesses and accountants, we feel raising awareness on the scheme as early as possible is fundamental in making this a smooth transition for our clients.

If you have any questions, please contact us on 01482 888820.